The UK government has announced significant changes to Stamp Duty Land Tax (SDLT) that will come into effect on 1 April 2025. Here's a comprehensive guide to help you navigate these new rules:

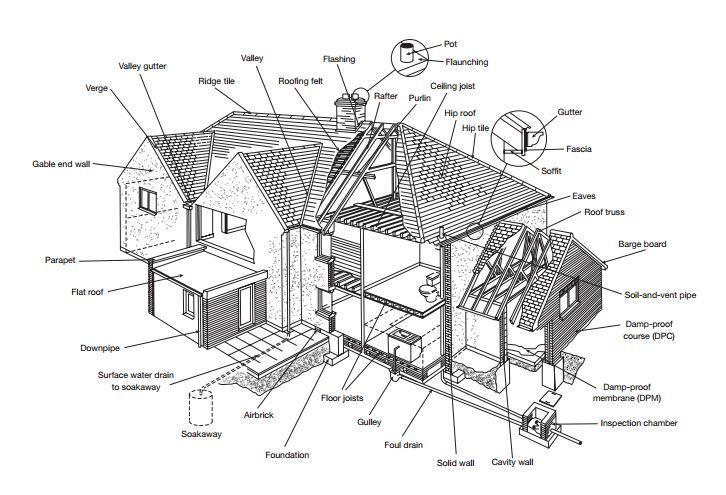

Which type of property survey is right for you? What does your report mean? Should you be worried? Chances are your questions are answered in our essential guide to property surveys...

Covid-19 Trading Update (19th July 2021)

Restrictions concerning the coronavirus pandemic are due to change on Monday 19th July, click the link for more info on our latest trading practices.

Hatch a plan to sell your home this Easter

It's no secret that moving house can be stressful. In fact, 60% of people have put off moving due to perceiving the change as too stressful*.

However, 62% of people surveyed believe that moving home can make them happier*.

So why not make the move you've been dreaming of? The process doesn't have to be disheartening, Property Ladder are here to make moving less stressful.

Begin your moving journey by booking a valuation today.

Selling a house can be stressful. Will you get what it's worth? Will it sell quickly or will it be sitting on the market for a long time?

Not many people know that the time of year can have an effect on your house sale. In fact, March and April are found to be the optimum time to put your house on the market, with homes taking 58 days on average to sell*.

The prime time to sell is when there are the most active buyers in the market and the Spring months see one of the highest rates of active buyers*. More buyers means more chance of finding someone who likes your house!

Why not simply take a look at what your house might be worth? With Property Ladder, you can get a free instant estimate with no obligations!

With the government announcing that the property market is staying open during England's second nation lockdown, we wanted to detail all the things we continue to do to keep you safe....

You are looking to refit your bathroom and dropping the rarely used bath for a spacious modern shower but are considering selling in the next few years... Will this hurt your property value or chances of selling?

This week, the EDP asked if we could shed some light on the mysterious world of a mortgage lender's valuer (In 150 words).

Unlike a building survey or homebuyers report, unless something goes wrong, most buyers will have zero contact with their mortgage companies appointed valuer, you usually won't even get a copy of the report.

So how do they come to their opinion of the value? Will they tell you if the place is falling down? Why do they sometimes not visit at all? Click here for a glimpse behind the wizards curtain...